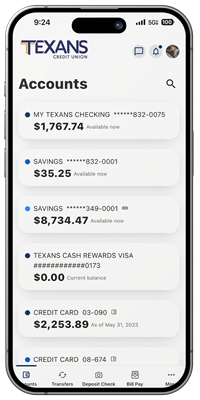

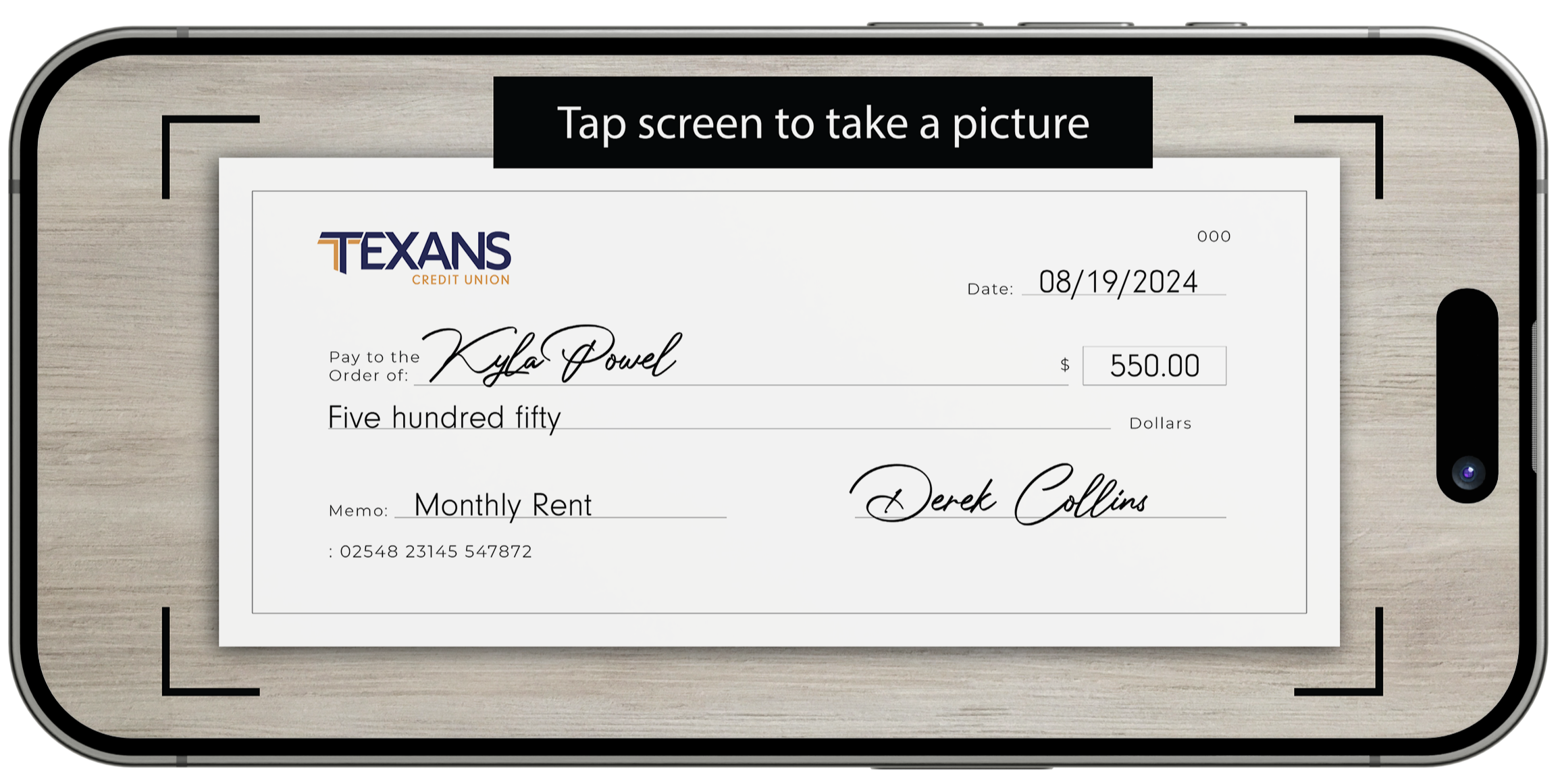

Deposit Check

Welcome to the future of banking convenience! With our digital banking platform, depositing a check has never been easier. Say goodbye to long waits and trips to the bank. In just a few simple steps, you can securely deposit your checks anytime, anywhere, using your smartphone or computer. Experience the freedom and efficiency of digital banking today!

Card Manager

Make your life easier with Card Manager, a powerful tool to manage your debit and credit cards anytime, anywhere. Set real-time account alerts, spending limits, and turn your card on and off. Enjoy access to personalized spending insights, advanced controls, and self-service options to create the card experience that's right for you.

Get started by logging in to Texans digital banking. Card Manager can be found in the Tools dropdown menu in Online Banking and at the bottom of your screen in your Texans mobile app.

Frequently Asked Questions

Yes, all Texans members can view their credit score and credit report for free with Credit Connection - available in Digital Banking and the mobile app. Even better, Credit Connection lets you set credit goals, track your progress, and simulate how actions you take may affect your credit score. It's your all-in-one tool for easily managing your credit health.

To view your credit score in Digital Banking, simply select Credit Connection from the Financial Planning drop-down menu. In the Texans mobile app, tap More, then Credit Connection.

Tap Transfers, then Make a Transfer to get started. If you have already added your outside account to Digital Banking, simply select it and complete your transfer as usual. If you need to make a transfer to or from a new external account, choose Add An Account from the To or From drop-down menu, then complete your transfer as usual.

All 1099 tax forms are sent out in January of each year. If you receive a paper statement, your 1099 tax form will be mailed to your address. If you are enrolled in e-Statements, your 1099 tax form will be delivered to your e-Statements portal. You can find your form in Digital Banking, by selecting e-Statements from the Accounts drop-down menu or in the mobile app by tapping More, then selecting e-Statements from the Accounts menu.

Outside accounts can be added to the mobile app from your dashboard by clicking Link and View External Accounts. Follow the simple on-screen instructions to link your accounts. Once you've added your outside accounts, you'll be able to view balances and account history on your dashboard and in the Accounts tab.

Accounts alerts can be set up by tapping More, selecting Alerts from the Tools drop-down menu, then toggling each desired account alert on or off.

To access your e-Statements using the Texans CU mobile app, tap More, then select e-Statements from the Accounts drop-down menu. If this is your first time accessing e-Statements, you will need to accept the e-Statement Terms and Conditions.

Up to $275 will be available immediately upon approval of your mobile deposit. Funds exceeding $275 will be available within 1-7 business days. Business days are Monday through Friday, excluding Federal Holidays.

Please reference our Funds Availability Policy for more information.

Standard ACH transfers will be available in your account the same day if made by 2:30 pm CT on business days. Standard ACH transfers made after 2:30 pm CT or on weekends or holidays will be available in your account the following business day. Standard ACH transfers made to or from a non-Texans account may take a few days to process.

All Instant Transfers will be available in your account immediately.

To register for a Digital Banking account, you will need to verify your identity by entering your social security number, date of birth, and one of the following: your member number, account or loan number, or debit or ATM card number. You can register online or by downloading the Texans CU mobile app.

After verifying your identity, create a username and password and authenticate your account by providing your security information, including your email address and phone number. After you have confirmed your contact information, your registration will be complete and you will be ready to log in.