0% APR Financing: How it Works

Many manufacturers offer 0% APR financing and cash rebates to drive traffic into their dealerships. 0% APR sounds pretty good, right? Not necessarily...

Only available to very well-qualified buyers with near perfect credit, so many applicants are ineligible for this rate

Much shorter terms (24-36 months vs. the average 60 months), meaning a larger monthly payment

May apply to slower selling models only, giving you less selection to choose from

Cash rebates normally do not apply with 0% APR financing, forcing you to choose between the two offers

Is 0% Financing Right for You?

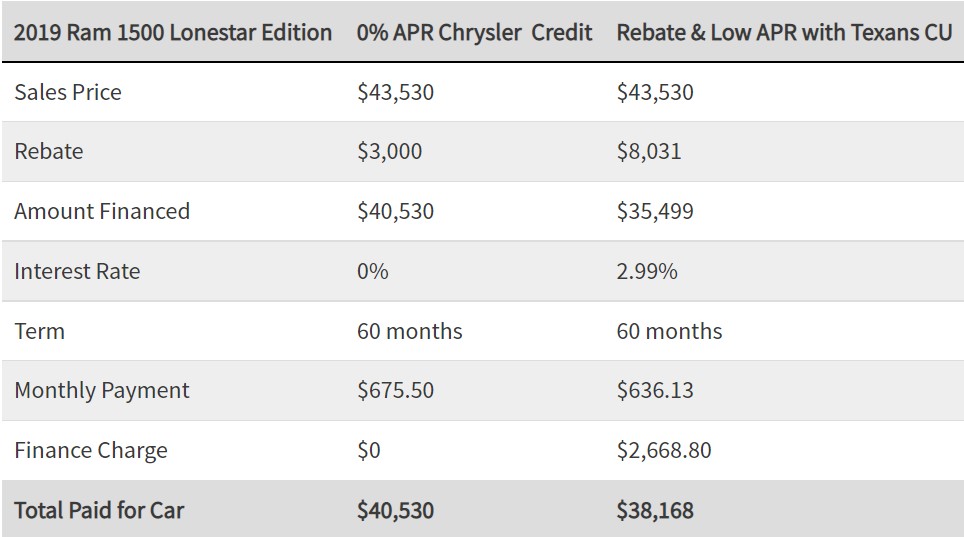

When the dealer offers a rebate as an alternative, you can often save more than if you chose 0% APR financing. Simply do the math to see your savings. When you apply the rebate as your down payment on the vehicle and include your low rate with Texans, you often come out ahead. Consider an example:

In this example, you're saving $2,362 over the life of the loan and saving over $39 each month on your car payment - an annual savings of $472.44!

The next time you see 0% APR financing, be sure to read the fine print and ensure you're getting the best deal by doing your homework, which includes getting pre-approved with Texans - you may be surprised to see how much you could save if you take the rebate and finance with your credit union instead!